Find Your Dream Home

Home is where the heart is. Let us help you on your search for peace and comfort in your own home.

The Home Buying Process

Buying a home is a big step!

Whether you’re buying your first home, your dream home, or your tenth investment property, yours will be a big investment. We know how important this is to you, and we have an army of experts to make sure we find the perfect property for your unique circumstances. We know the market and love real estate, and we’ll educate you throughout the buying experience.

Finding the perfect property is just one way we can help you with your real estate purchase. As real estate agents, we have ongoing access to experts in every related field from lending to relocation.

Start Your Home Search

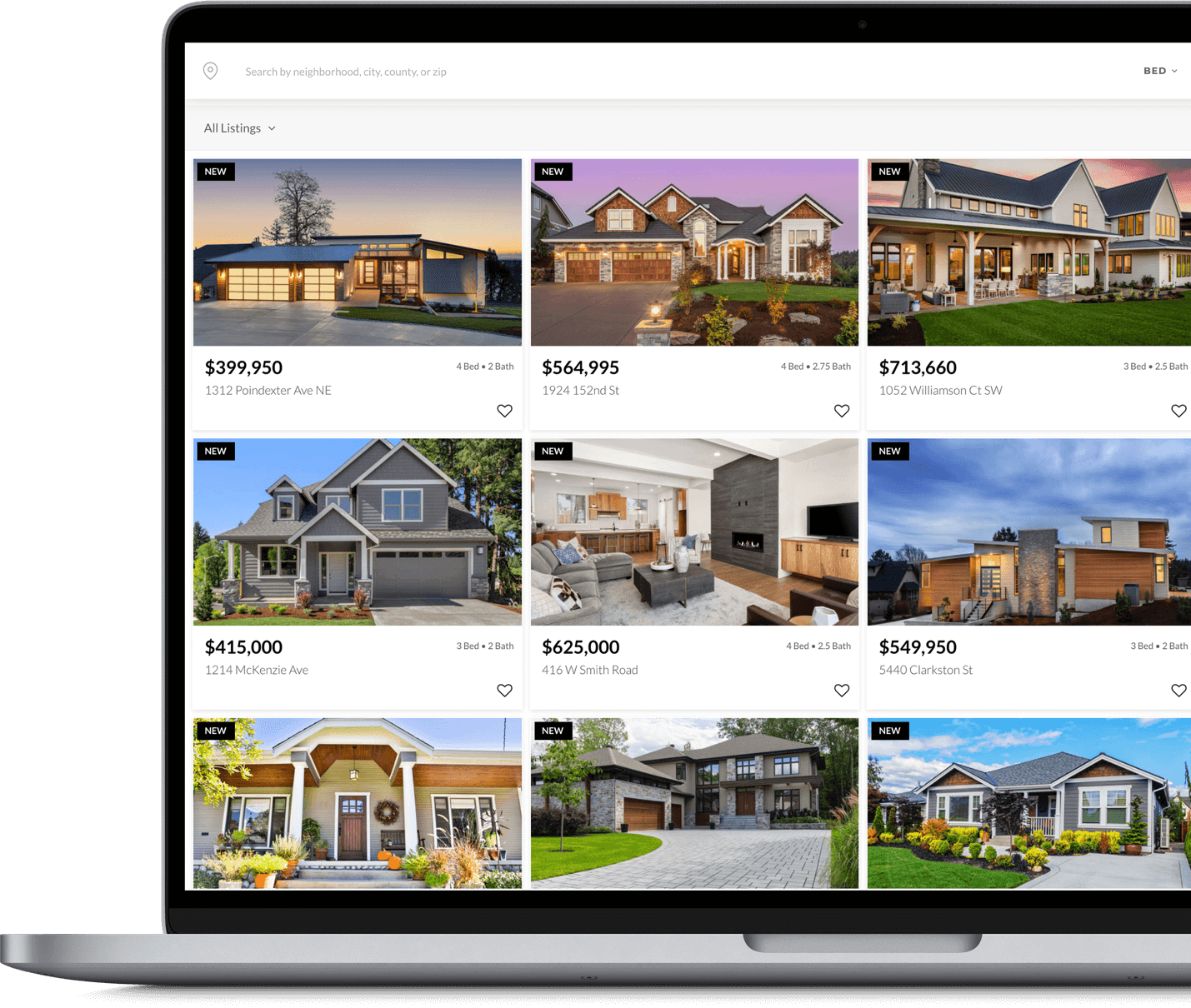

Search for homes anywhere, anytime

When you are ready to buy a home, start by making a wish list and setting a budget. Depending on your finances, you may need to choose a lender to get pre-approved for a loan so you can better understand your buying power. The pre-approval letter will also illustrate your financial readiness to sellers and make your offers more compelling.

You can search for the perfect property using this website on any device, including your desktop, laptop, tablet, or smartphone.

Start Searching

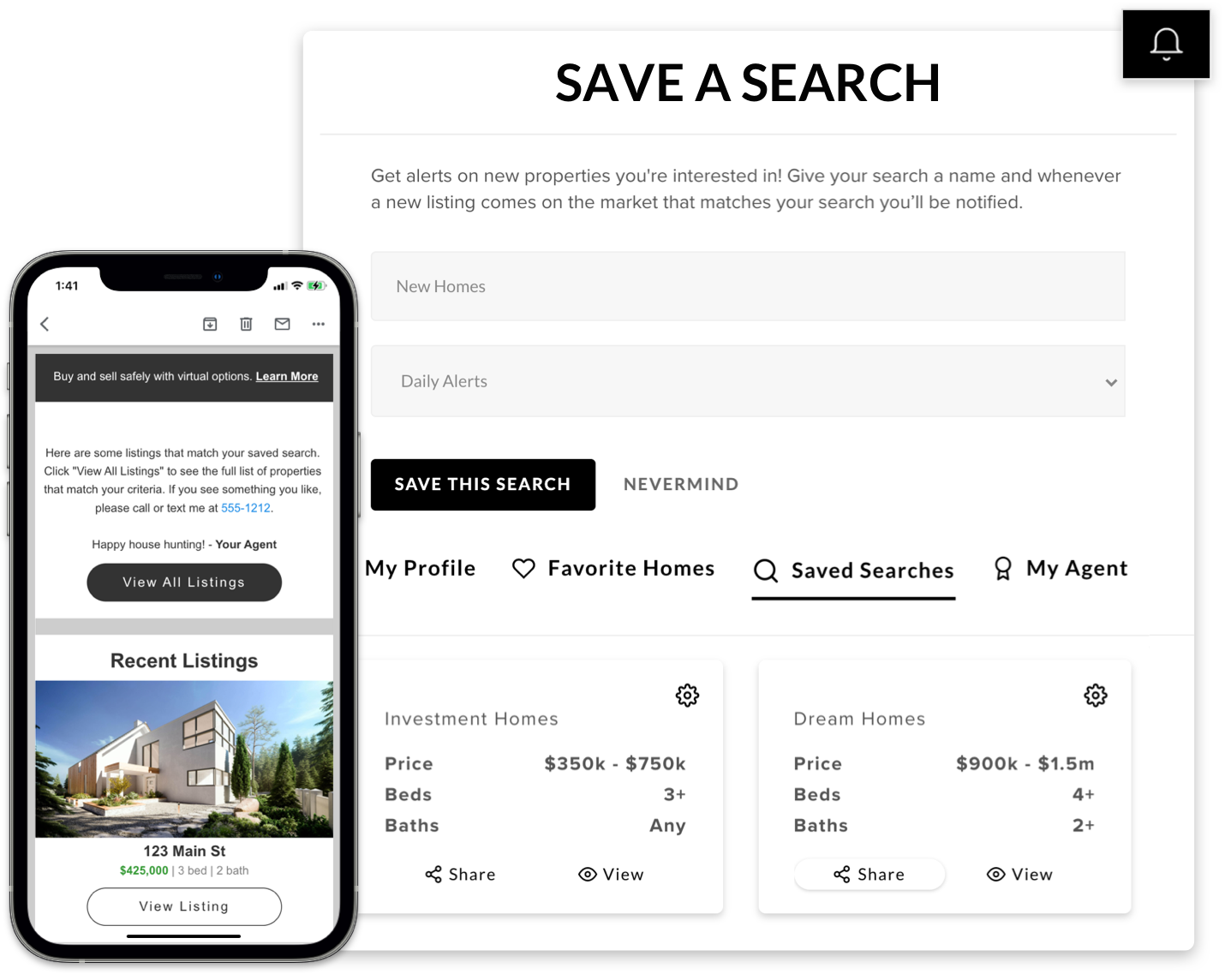

Sign Up for Listing Alerts

Be the first to know when a new property hits the market

Listing Alerts give you the edge over others looking to buy – once you register for Listing Alerts, an email is delivered straight to your inbox the moment a new property that matches your wish list criteria hits the market, enabling you to act fast.

Get Set Up

GetPre-Approval

Before you start looking for a home to buy, it’s a good idea to meet with your Loan Officer to get pre-approved for a loan amount. At this stage, the lender gathers information about income, assets and debts of the borrower (you) to determine how much house you may be able to afford. This includes a credit report, W-2 forms, pay stubs, Federal Tax Returns and recent bank statements. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

Application & Processing

What happens when a loan goes 'Live'

When you find property you’re ready to buy, your lender will help you complete a full mortgage loan application, and talk you through the various fees and down payment options. The application is submitted to processing, where the documents are reviewed and appraisals and title examination are ordered. Then the loan is sent to an underwriter, who reviews and approves the entire loan if it meets compliance.

Making An Offer And Closing

Partners Throughout the Home Buying Process

When you find a home you love, it’s time to submit an offer. Once your offer is submitted by your agent and accepted (typically after some negotiation), the next steps are moving through the inspection, appraisal, and closing processes in the most stress-free way possible. In addition to partnering with experts in each of these fields, having a knowledgeable agent to oversee the escrow process and ensure each deadline is being met on time is critical. You can rest assured that your agent is always acting in your best interest with a dedicated buyers agreement in place.

With the right support, each step of the homebuying process will feel seamless and easy so that you can focus on getting the keys, throwing a housewarming party, and making lasting memories in your new home!

Let's Connect