Published July 23, 2025

What is a Pre-Approval? Mastering the Process to Getting Pre-Approved by a Lender

Before you even dream of scrolling through listings, getting a mortgage pre-approval is the single most powerful move you can make. This is where a lender digs into your finances to figure out exactly how much they're willing to lend you. It gives you a rock-solid budget and a pre-approval letter—the document that proves you’re a serious buyer.

This piece of paper is your ticket to competing in a tough housing market.

Why Pre-Approval Is Your Key to Buying a Home

Think of your pre-approval letter less as a chore and more as your secret weapon. It instantly changes your status from a casual "looker" to a credible homebuyer in the eyes of sellers and their agents. When you make an offer with that letter, you're not just saying you want the house—you're proving you have the financial muscle to actually buy it.

This process gives you two huge advantages: a concrete budget and serious negotiating power. Knowing your exact approved loan amount saves you from the heartache of falling for a home that's financially out of reach. It anchors your search in reality, so you can focus only on properties you can genuinely afford.

Setting Yourself Apart in a Competitive Market

Picture this: a seller gets two nearly identical offers. Buyer A has a pre-approval letter from a reputable lender. Buyer B has a flimsy pre-qualification (or nothing at all). Who do you think the seller takes more seriously?

It’s Buyer A, every time. The seller knows their financing is already vetted and the deal is very likely to close smoothly. Buyer B is a total gamble. Their loan could fall through, forcing the seller to put the house back on the market and start all over again.

In a bidding war, a strong pre-approval letter is often the tie-breaker that gets your offer accepted. It erases the financial uncertainty for the seller, making your offer feel safer and far more attractive.

Even if the offers are for the same price, the pre-approved one almost always wins. That’s the real-world power of getting this step done before you start your house hunt. It’s all about building confidence—for you and for the seller.

A pre-qualification, on the other hand, is a much quicker, less formal estimate based on self-reported information. A lender might give you one after a 15-minute phone call. It's a good starting point but carries very little weight with sellers because nothing has been verified.

Here’s a quick breakdown of how these two terms stack up.

Pre-Approval vs. Pre-Qualification at a Glance

| Factor | Pre-Qualification | Pre-Approval |

|---|---|---|

| Process | Quick estimate based on self-reported financial info. No deep dive. | In-depth financial review with verified documents. |

| Verification | None. The lender takes your word for your income and assets. | Full verification. Lender pulls your credit and checks pay stubs, bank statements, and tax returns. |

| Weight with Sellers | Low. Seen as a casual first step. Doesn't prove buying power. | High. Signals you are a serious, financially-vetted buyer ready to close. |

| Confidence Level | Provides a rough idea of what you might afford. | Gives you a firm, reliable budget to shop with. |

| Best For | Early-stage planning, months before you're ready to buy. | Actively shopping and making offers. |

Think of it this way: a pre-qualification is like saying, "I think I can run a marathon." A pre-approval is like showing up with your race bib, having already completed all the qualifying heats.

The Evolution of Lending

The good news is that this process has gotten much more efficient. Thanks to major strides in technology, what used to take weeks of paperwork and waiting can now happen much faster. The digitization of mortgage lending allows for quicker, more accurate assessments of your financial picture. This not only speeds up your pre-approval but also helps you move faster when you find the right house. If you're curious about the nitty-gritty, you can find some great insights from experts in the field on how lending has evolved.

Ultimately, taking the time to get pre-approved shows everyone involved that you're prepared, serious, and ready to go. It’s the simple step that turns you from a dreamer into a contender.

Get Your Paperwork Ready for a Smooth Pre-Approval

Jumping into the mortgage pre-approval process can feel a little intimidating, but it's really just about telling your financial story through paperwork. Think of it this way: lenders aren’t just looking for forms; they're trying to piece together a clear picture of you as a reliable borrower.

Getting organized from the very start is one of the smartest things you can do. It can literally save you weeks of frustrating back-and-forth and shows the lender you're a serious, well-prepared applicant.

Every document you provide is a chapter in your financial biography. Your pay stubs show your current earning power, while tax returns tell the longer story of your income stability. Bank statements reveal your saving habits and prove you have the cash for a down payment. The real goal is to present a complete, straightforward narrative that makes the lender's decision an easy "yes."

Proving Your Income

This is the core of your application. You need to show that you have a steady, reliable cash flow that can comfortably handle a monthly mortgage payment. What you'll need depends entirely on how you earn your living.

- If You're a W-2 Employee: This is usually the most direct path. You'll need your most recent pay stubs covering a 30-day period, plus your W-2 forms from the last two years. This combo gives the lender a snapshot of your current income and a track record of consistent employment.

- If You're Self-Employed or a Freelancer: Lenders need to see a stable, long-term income pattern, especially since your earnings might not be the same every month. Plan on providing at least two years of your business and personal tax returns. Many will also request a year-to-date profit and loss (P&L) statement and your most recent business bank statements to get a current view.

A common snag for freelancers is co-mingling personal and business expenses. Keeping your finances in separate accounts makes it infinitely easier for underwriters to see what your actual income is.

Showing Your Assets and Debts

Lenders need the full 360-degree view of your financial health—not just what you earn, but what you own and what you owe. This helps them calculate your debt-to-income (DTI) ratio and confirms you have enough funds for closing costs and your down payment.

For assets, you'll typically need to gather:

- Bank statements from the last two to three months for all of your checking and savings accounts.

- Statements from any investment accounts, like 401(k)s, IRAs, or brokerage accounts.

- If you're lucky enough to get a down payment gift, you'll need a signed gift letter from the person giving it to you, along with proof they transferred the funds.

Pro Tip: Before you even start, create a secure digital folder on your computer or cloud drive and label it "Mortgage Docs." As you download each PDF, just drop it in. When your lender asks for a specific document, you can send it over in seconds instead of frantically digging through your files.

When it comes to your debts, the lender will pull most of this from your credit report. However, you should be ready to provide statements for things like student loans, car loans, or any other mortgages you might have.

Transparency is non-negotiable here. Trying to hide a debt will only create a much bigger headache when the underwriter inevitably finds it. Being upfront from the beginning allows your loan officer to factor everything in, making sure the entire mortgage pre-approval process is smooth and your final loan doesn't hit any last-minute snags.

What Lenders Look For During The Review Process

Once you hit "submit," your application doesn't just land in a pile. It goes straight to an underwriter, the person tasked with the critical job of verifying every detail of your financial life. This is where the real mortgage pre-approval process begins.

Think of lenders as professional risk managers. Their primary job is to get comfortable with your ability to make mortgage payments, on time, for the life of the loan. To do that, they zero in on a few key areas to build a complete picture of you as a borrower.

Your Credit And Financial History

First things first: the credit pull. An underwriter will immediately pull your credit report and score. You don't need a perfect 850 score to get a great loan, but a strong score is proof of responsible borrowing, which almost always unlocks better interest rates.

They are specifically scanning for red flags like:

- A history of late payments, especially on rent or a previous mortgage.

- Any accounts that have gone to collections or been charged off.

- Major events like bankruptcies or foreclosures.

- A sudden spike in new debt right before applying.

A single blemish isn't necessarily a deal-killer, particularly if there’s a good story behind it. But a pattern of missed payments or maxed-out cards signals risk, and that makes an underwriter’s job much tougher. The best move you can make is to know exactly what’s on your credit report before you even talk to a lender.

Your Capacity To Repay The Loan

This all boils down to your debt-to-income (DTI) ratio. It’s the single most important number in your application, representing the percentage of your gross monthly income that goes toward paying off existing debts.

Your DTI ratio tells a lender exactly how much of your paycheck is already spoken for. It gives them a crystal-clear look at whether you can realistically shoulder a new mortgage payment without financial stress.

Let's look at a real-world example. Alex brings home a solid $10,000 a month. Sounds great, right? But Alex also has a $700 car payment, $1,200 in student loans, and $800 on credit cards. That's $2,700 in monthly debt payments.

If the lender has a DTI cap of 43%, Alex's total monthly debt—including the new mortgage—can't exceed $4,300. After subtracting the existing $2,700, Alex is left with a maximum possible mortgage payment of only $1,600. It's a perfect illustration of how a high income doesn't automatically mean high borrowing power if your DTI is already stretched.

Your Financial Stability And Assets

Finally, lenders need to see stability. A consistent two-year employment history, ideally in the same job or field, is the gold standard. Changing jobs isn't a deal-breaker, but a jump to a completely new industry or a switch from a W-2 salary to a 100% commission role can raise some serious questions.

They will also verify that you have enough money for the down payment and closing costs, what we call your "cash to close." Be prepared to explain any large, recent deposits. A random $20,000 that appeared in your checking account last month is a huge red flag for underwriters, as it could be an undocumented loan from a relative.

This whole evaluation process sets the stage for what happens next. With the market constantly shifting, lenders and borrowers are navigating the economy carefully. Recent mortgage lending statistics from the UK's FCA show how new loan commitments ebb and flow with these conditions, making a clean, well-documented financial profile more crucial than ever.

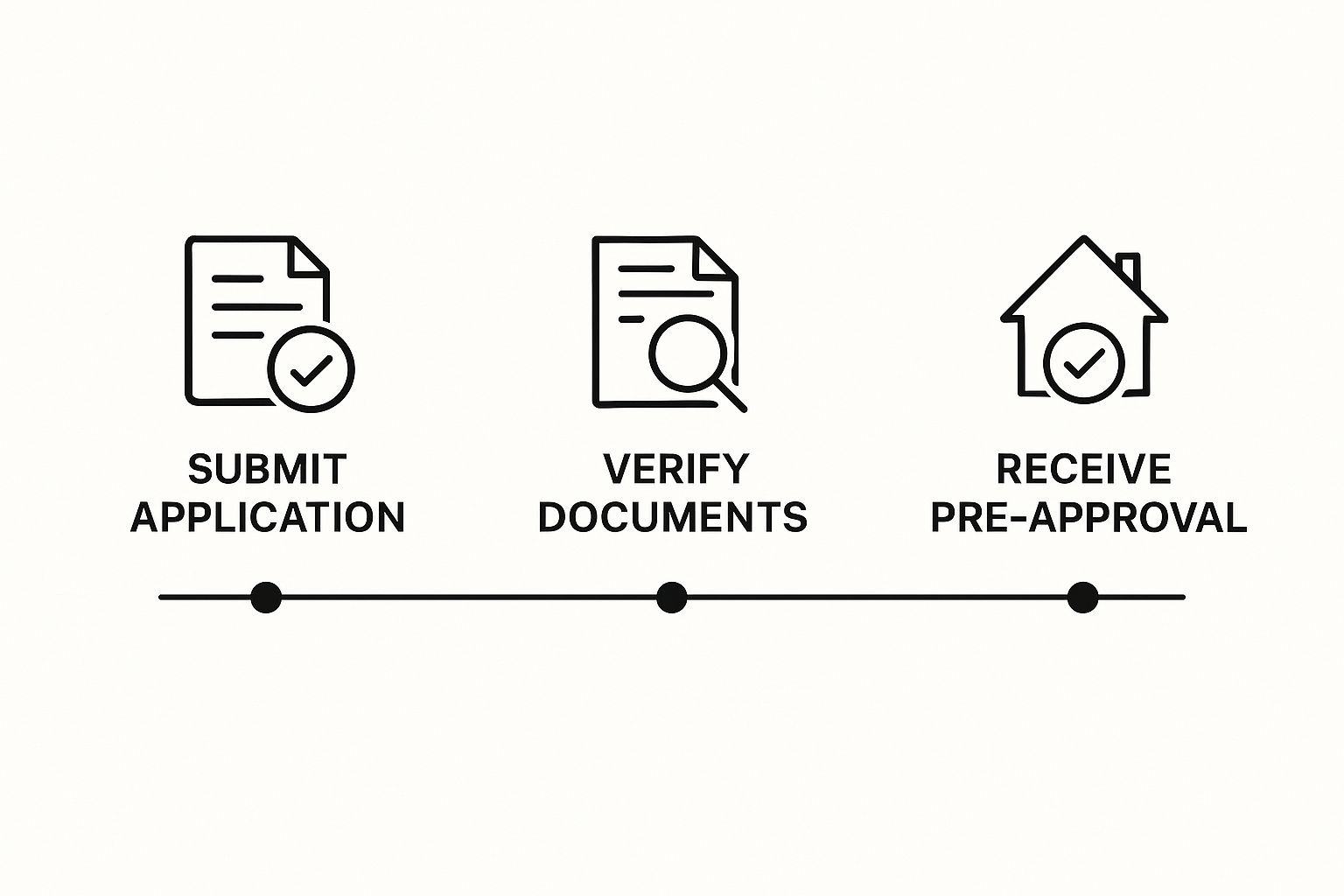

The Pre-Approval Timeline And Your Next Moves

So, you’ve submitted your application. What happens now? This is where things start moving fast. While every lender’s exact turnaround time can vary depending on their current workload, the whole journey from application to pre-approval letter is surprisingly quick—if you’ve done your homework and have your documents ready.

You can generally expect things to wrap up within a business week. Often, your loan officer will circle back within a day or two to ask for any last-minute documents or to clarify a detail on your application. From there, it’s off to the underwriter for the official review, which usually takes another couple of days. For a buyer who has all their ducks in a row, getting that official letter can take as little as three days, but it's smart to plan for up to a week.

Here’s a simplified look at what to expect day-by-day.

As you can see, the process is front-loaded. Getting your paperwork organized from the very beginning is what makes everything else move smoothly.

Life After Pre-Approval

Once that pre-approval letter lands in your inbox, it's go-time for house hunting. But this is also the moment when your financial life goes under a microscope. Think of it as a "financial quiet period."

That letter isn't a blank check that lasts forever. It’s a conditional commitment from the lender that’s usually valid for 60 to 90 days. Why the expiration date? Because your financial snapshot—your credit, income, and debt—needs to be fresh. If your house hunt takes longer, don’t worry. You’ll just need to touch base with your lender to get it refreshed, which typically just means providing updated pay stubs and bank statements.

Keep in mind, bigger market forces are at play, too. Things like seasonal demand and economic shifts can tweak the lending environment. To get a better sense of the current climate, you can dig into how market dynamics are impacting buyers right now.

The Dos And Don'ts While You House Hunt

You’re pre-approved—congratulations! Now, the single most important thing you can do is keep the exact financial profile you were approved with. Any sudden moves can put your final loan approval at risk, even after you have an accepted offer on a home.

What You MUST Do:

- Keep paying your bills on time. Every single one. This is non-negotiable for keeping your credit score right where it needs to be.

- Keep saving money. You’ll need every penny for closing costs, moving expenses, and the little surprises that always pop up.

- Stay in touch with your loan officer. Give them a heads-up about any potential financial changes before you make them.

What You MUST NOT Do:

- Don't make any large purchases on credit. No new cars, no financing a roomful of furniture, no big-ticket electronics. This can wreck your debt-to-income ratio overnight.

- Don't change jobs. A new job, especially if it changes how you’re paid (like moving from salary to commission), is a huge red flag for underwriters.

- Don't apply for new credit. Don’t open a new store card to save 15% or apply for another loan. Each inquiry can ding your credit score.

- Don't make large, undocumented cash deposits. Lenders have to source every dollar. That mattress money or a "gift" from a relative that isn't properly documented will cause major delays.

Stick to these rules. Your discipline during this phase is what turns a pre-approval letter into a set of keys to your new home. Get this part right, and the final steps to closing will be as smooth as possible.

Avoiding Common Pre-Approval Pitfalls

The mortgage pre-approval process is all about giving you the confidence to start your home search. But I’ve seen deals fall apart right before closing because of a few common, and totally avoidable, missteps. The key is knowing what lenders are looking for—and what can make them hit the brakes.

Remember, a pre-approval letter isn't the final word. The bank will take one last, deep dive into your finances during the final underwriting process. Your goal is to make sure nothing has changed that could turn that pre-approval into a denial.

Forgetting About Hidden Debts

One of the most common surprises that torpedoes a mortgage application is a "forgotten" debt. It happens more often than you’d think.

Here’s a classic scenario I’ve seen play out: A buyer co-signed a car loan for their sister years ago. They completely forgot about it because the sister always paid on time. But when the underwriter pulls their full credit profile, that $400 monthly payment suddenly pops up, wrecking their debt-to-income (DTI) ratio and putting the whole loan at risk.

Your best defense is a good offense. Pull your own complete credit report from all three bureaus before applying. Go through it with a fine-tooth comb and account for everything tied to your name, from co-signed loans to old store credit cards you thought were closed. Tell your loan officer about everything upfront so they can factor it in from the start.

Underestimating Your Debt-To-Income Ratio

It's easy to focus on your income and forget that lenders care just as much about what you owe. A great salary doesn’t mean much if most of it is already spoken for by car payments, student loans, and credit card bills.

Lenders live and die by DTI thresholds. If your new mortgage payment pushes you over their limit—even by a little bit—your final loan approval could get denied. This is a huge tripwire for buyers carrying significant student loan debt or multiple car payments.

The lender isn't just looking at what you earn; they're looking at what you owe. Your DTI ratio is the key metric that determines your true borrowing capacity, and underestimating it is a recipe for disappointment during the final review.

Making Big Financial Moves After Pre-Approval

Once that pre-approval letter is in your hand, your financial life needs to go on lockdown. I call it the "quiet period." Lenders can—and absolutely will—re-check your credit, employment, and bank accounts right before closing day. Any sudden changes can be a massive red flag.

These are the moves that do the most damage:

- Financing a new car or a house full of furniture: This adds a new monthly payment and instantly messes with your DTI.

- Changing jobs: Switching to a new company in a different industry, or moving from a W-2 job to a commission-based role, creates doubt about your income stability.

- Applying for new credit: Don't open that new store credit card just to get a 15% discount. Every new application triggers a hard inquiry on your credit, which can ding your score at the worst possible time.

Think of your financial profile as being frozen in amber from the moment you’re pre-approved. Your only job is to keep it that way until you’re holding the keys to your new home. Sticking to the status quo is the single best way to ensure a smooth closing.

Your Top Questions About Mortgage Pre-Approval, Answered

Even the most prepared homebuyer has questions when it comes to getting pre-approved. It's a critical step, but some parts can feel a bit like a black box. I’ve heard just about every question there is, so I've gathered the most common ones to give you direct, clear answers.

Let's clear up any confusion so you can move forward with confidence.

Will Getting Pre-Approved Hurt My Credit Score?

Yes, but don't let that scare you. The process involves a "hard inquiry" on your credit report, which usually causes a small, temporary dip of a few points. It’s a necessary part of the process.

The good news is that modern credit scoring models are built for this. They understand that smart buyers shop around for the best mortgage rate. That's why multiple mortgage inquiries made within a short window—usually 14 to 45 days—are bundled together and treated as a single event. This lets you talk to different lenders and compare offers without getting dinged for each and every application.

How Long Does a Pre-Approval Last?

A mortgage pre-approval isn't good forever. Think of it as having an expiration date, which is typically 60 to 90 days.

Why the short lifespan? Because your financial life is a snapshot in time. Lenders need to know that your income, debts, and savings are still solid when you're ready to make an offer. If your home search takes a bit longer, don't sweat it. You'll simply reconnect with your lender to refresh the letter, which usually just involves providing updated pay stubs and bank statements to show nothing significant has changed.

Think of your pre-approval letter as a ticket with an expiration date. Its value comes from being fresh and accurate, assuring sellers that your finances are solid right now.

Can I Be Denied a Mortgage After I'm Already Pre-Approved?

Unfortunately, the answer is yes. A pre-approval is a very strong conditional commitment from a lender, but it's not a final, ironclad guarantee. The real green light comes during the final underwriting stage, just before you close on the house.

A pre-approval can fall through if your financial situation changes for the worse after you get the letter. Some of the most common reasons I've seen for this are:

- Taking on new debt: This is a big one. Financing a new car, opening a new credit card, or buying a house full of furniture on credit can throw your debt-to-income (DTI) ratio out of whack.

- A change in your job: Losing your job is an obvious red flag, but even switching to a commission-based role or a new industry can make lenders nervous about your income stability.

- A sudden drop in your credit score: Missing a payment on a credit card or another loan can be enough to drop your score below the lender's minimum.

- Problems with the property itself: The house has to meet the lender's standards, too. If it appraises for less than your offer price or a major structural issue is discovered, the loan could be denied.

The best advice? Just stay financially disciplined between your pre-approval and your closing day. It’s the surest way to get to the finish line without any last-minute surprises.

Ready to start your home search with confidence in the Greater Philadelphia area? The team at The Gaddy Group provides expert guidance through every step of the mortgage pre-approval process and beyond. Explore listings and connect with an agent today.